Your Goals. Your Roadmap. Our Guidance.

-

Income Tax Planning

-

Retirement Income Planning

-

Financial Planning

-

Investment Management

-

Estate Planning & Trust Services

Income Tax Planning

Navigating the ever-changing tax codes can be daunting. With our income tax planning services, you don't have to face it alone. We stay updated on all tax changes and ensure you're always informed. Our goal is to help you maximize your lifetime tax savings. At Embrace Wealth Management, we keep you up-to-date on new tax developments so you can rest easy knowing your taxes are in good hands.

Tax Smart Withdrawals

We help you in making wise withdrawal decisions from your various accounts. We aim to extend the longevity of your retirement savings, maximize growth, and minimize lifetime taxes.

Your Questions. Our Focus

How much do I need to retire, and when can I realistically do it?

How much can I safely spend each year in retirement without running out of money?

How should I invest before and after retirement to balance growth, income, and risk?

How do I minimize taxes over my lifetime with smart withdrawal and Roth strategies?

When should I claim Social Security and pension benefits to maximize lifetime income for my household?

Financial Planning

We are dedicated to offering personalized financial solutions that align with your unique goals and aspirations. Our experienced team provides expert advice on taxes, retirement plans, and comprehensive financial planning. Our holistic approach extends beyond investments, empowering you to pursue your dreams and establish a solid financial foundation for the future.

Your Questions. Our Focus.

Am I invested in the right way for my goals and risk tolerance?

Am I paying more in taxes than I need to, and what strategies can reduce my tax bill over time?

Will my savings, pensions, and other assets truly get me to and through retirement?

How do I protect my plan from big risks like market drops, scary headlines, and unexpected health issues?

What happens if I need to support my parents, or if I get sick, and how can I make sure my family is financially cared for?

Our Investment Management Process

Decision-Making

We base our decisions on clear, evidence-based principles.

Asset Allocation

We strategically allocate your assets to maximize growth while minimizing tax exposure.

Low-Cost Portfolios

We utilize index and exchange-traded funds to provide global market access, diversification, and lower fees.

Diversification

We design diversified investment portfolios to achieve more stable returns.

Rebalancing

We regularly adjust your portfolio to maintain your desired risk level and capitalize on market opportunities.

ESG Investing Approach

We align your investments with sustainable goals, avoiding those that harm the Earth or humanity.

Is your portfolio on the right track?

Our advanced tools can help you identify areas for improvement and create a personalized investment strategy that aligns with your goals. Take our quick questionnaire today!

Investing is subject to risk, which may involve loss of principal. No strategy protects against loss. Past performance is no guarantee of future results. Nitrogen, Inc. is a member of LPL’s vendor affinity program and is not affiliated with LPL.

Estate Planning & Trust Services

Estate planning is truly important to us. We’ll review what you already have or help you put new pieces in place—whether that’s trusts, wills, health care directives, or powers of attorney. Our team will walk you through each step using Wealth.com, making sure you’re organized, your wishes are clear, and your family is looked after. You’ll have access to all the essential documents you need to protect your legacy and provide for the people who matter most.

Our Trustee Toolbox & Family Mission Meetings

Estate planning is about more than just managing assets—it’s about capturing your values and sharing your life story. With our Trustee Toolbox, we help you keep your important documents safe and organized. We also bring families together for Family Mission Meetings, where we walk everyone through your estate plan and talk about your wishes. These sessions are all about making your intentions clear and giving your loved ones confidence for the road ahead.

-

We offer comprehensive financial planning, income tax planning, retirement income strategies, investment management, and estate planning & trust services for clients in Chico, the Northern California region, and across the United States. Our team tailors every service to fit local and national needs.

-

Yes, our advisors help clients throughout the country make smart withdrawal decisions, extend retirement savings, and minimize taxes across various state and federal tax laws. We combine local expertise with a national perspective to maximize results.

-

Absolutely. While we are based in Chico, CA, we work virtually and travel as needed to support estate planning and legacy conversations for clients nationwide, always respecting the unique requirements of each state.

-

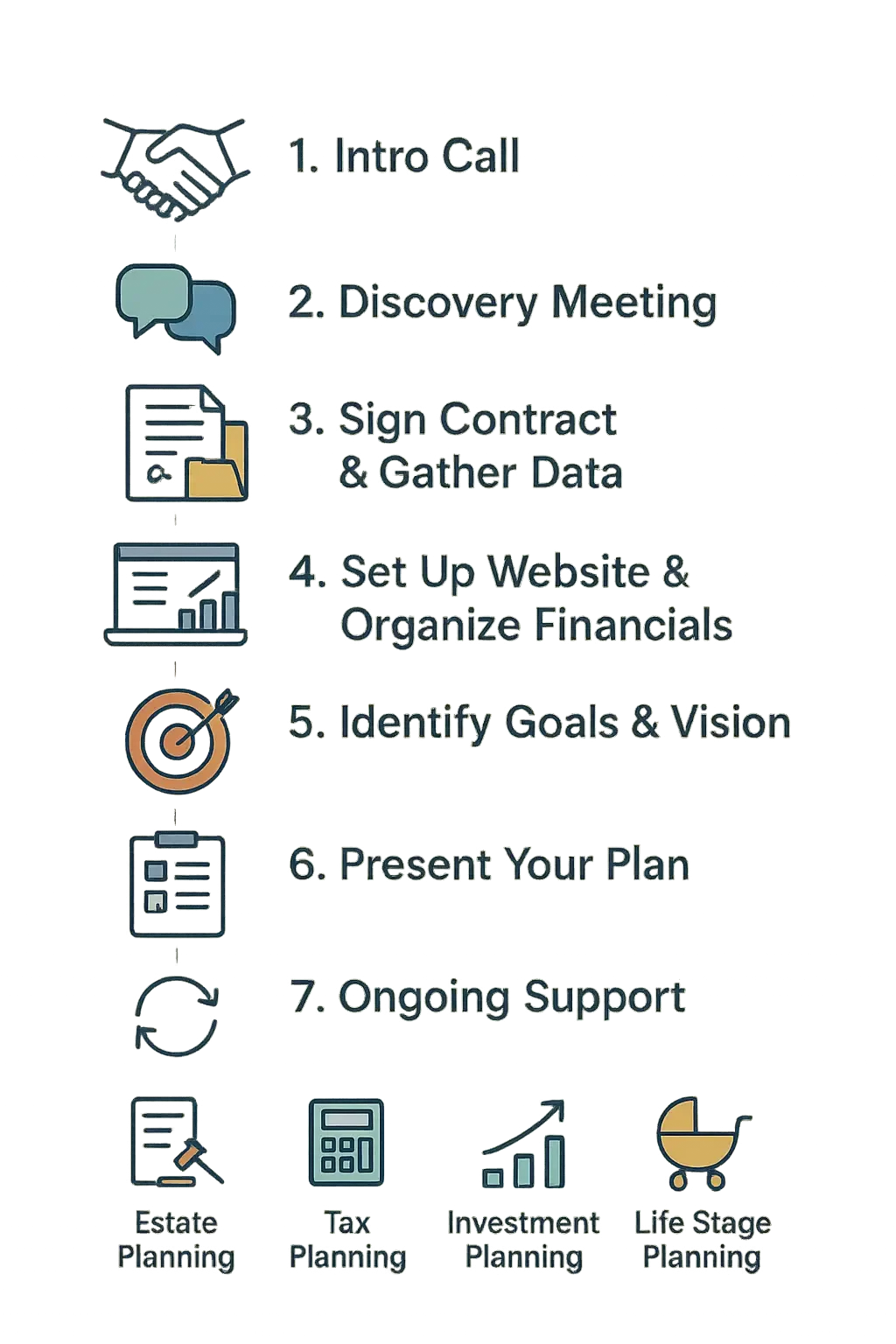

We start every relationship with a no-cost, no-pressure conversation to understand your goals. Using advanced financial planning tools, we craft investment strategies for individuals and families both locally in Chico, throughout Northern California, and nationwide—whether you’re approaching or enjoying retirement.

-

We help you find answers to questions like:

Am I on track with my investments, no matter where I live?

How can I manage taxes in my home state or as I relocate?

Do my assets support my retirement goals if I move or travel?

What should I do about unexpected life or family changes—locally or from afar?

-

Yes! Our first meeting is complimentary, whether you’re in Chico, Northern California, or elsewhere in the US, so you can see if we’re the right fit for your needs, with no obligation.