Investment Management

Curious if your investment portfolio is heading in the right direction?

Our advanced analysis tools pinpoint areas for improvement and help build a personalized investment strategy based on your unique goals. Take our quick questionnaire to get custom suggestions and see where you can optimize performance.

Investing is subject to risk, which may involve loss of principal. No strategy protects against loss. Past performance is no guarantee of future results. Nitrogen, Inc. is a member of LPL’s vendor affinity program and is not affiliated with LPL.

Our Investment Management Process

Decision-Making: We utilize evidence-based principles to guide every investment decision.

Asset Allocation: Your assets are strategically placed to minimize the tax burden on high-growth investments.

Low-Cost Investing: We focus on index funds and ETFs for broad diversification, global access, and lower fees.

Diversification: Portfolios are built with diverse assets to help smooth out returns and reduce risk.

Rebalancing: We adjust portfolios regularly to keep your risk level balanced and to capture opportunities as markets change.

ESG Investing: We offer sustainable investment options, letting your portfolio reflect your personal values and positive impact on the world.

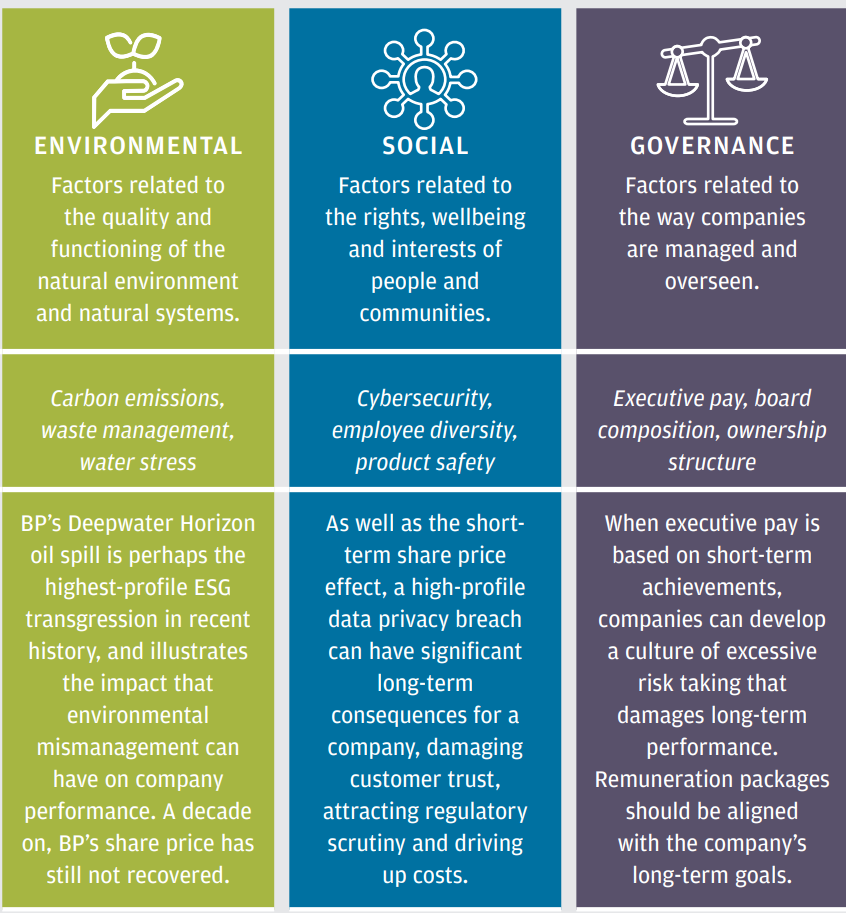

Sustainable Investing means investing with purpose as well as profit.

We know how important it is for clients to avoid supporting companies that harm the environment or society. Our approach follows your values and considers climate change, human rights, corporate ethics, women’s rights, and sustainable farming—mitigating ESG risks for stronger portfolio performance and a positive impact on the world.

Why Sustainable Investing Matters

Sustainable investing matters because it helps lower risks by focusing on companies and funds that address climate change, social equity, and good governance.

By considering environmental, social, and governance (ESG) factors, investors often achieve competitive long-term returns while promoting ethical and responsible business practices.

-

Popular options this year include high-yield savings accounts, certificates of deposit (CDs), short- and intermediate-term bond funds, diversified stock portfolios, and gold. Each offers different levels of risk and return, so match your choices to your goals, time horizon, and comfort with risk.

-

If you are retired, the priority is preserving your capital while generating steady income. Experts recommend a well-diversified portfolio that balances stocks, bonds, and cash. Consider dividend-paying stocks, blue-chip funds, short- to intermediate-term bonds, and cash reserves for 1–2 years of living expenses. Do not become overly conservative—some equity exposure helps outpace inflation. Reassess your risk tolerance and rebalance regularly to maintain the right mix for income, growth, and stability.

-

To find the best money market account rates, check reputable online resources that update rates daily. Top sites include NerdWallet, Bankrate, Investopedia, CNBC Select, and Fortune. These platforms compare APYs, minimum balances, fees, and account features, helping you quickly spot the most competitive offers for your needs.

-

Stocks represent ownership in companies and can offer high returns but with more volatility. Bonds are loans to companies or governments, providing steady income with lower risk. ETFs (exchange-traded funds) are baskets of stocks or bonds, giving you instant diversification and easy trading like stocks.

-

Gold can be accessed through ETFs, mutual funds, or shares of mining companies—no need to buy physical gold. Other alternatives include real estate, private equity, and thematic funds (like AI or renewable energy). These assets can diversify your portfolio and hedge against market swings.

-

Low-risk options include high-yield savings accounts, CDs, U.S. Treasurys, investment-grade bonds, and money market funds. These are best for preserving capital and earning modest returns, especially for short-term needs or as a cushion in volatile markets. However, keep in mind that the returns on these safe investments may not always keep up with inflation, which can erode your purchasing power over time.

-

Individual stocks can offer big gains but come with higher risk and volatility. Index funds and ETFs provide broad market exposure, lower fees, and diversification, which reduces risk. Importantly, stocks have historically been one of the best ways to grow wealth over the long term, thanks to compounding and the market’s general upward trend—even with short-term ups and downs. Keeping some stock exposure in your portfolio can help you achieve your long-term financial goals.

-

AI-focused ETFs, tech sector funds, and shares in companies leading in automation and data are hot topics. These investments offer growth potential but can be volatile, so balance them with more stable assets.

-

Look for dividend-paying stocks, bond funds, REITs (real estate investment trusts), and preferred stocks. Many ETFs offer dividend reinvestment plans (DRIPs) for compounding growth. The right mix depends on your income needs and risk profile.

-

Avoid trying to time the market, putting all your money in one investment, ignoring fees, and making decisions based on emotion. Stay focused on your long-term plan, diversify, and review your portfolio regularly to stay aligned with your goals.