Retired Women

Retirement Planning for Women

Whether preparing for retirement or enjoying it, we offer tailored planning solutions just for you. We’ll help with saving, investing, understanding Social Security, managing taxes, and navigating Medicare. Our guidance covers securing income, smart investing, and planning for long-term care. You’ll also get support with estate planning, charitable giving, and shaping your legacy.

Planning for Your Ideal Life 💸

What do you dream of doing in retirement? 💭 We’ll help you create a budget to support your goals, travel, hobbies, new adventures, or family time.

Making Your Money Last 💰

Let’s review ways to maximize your retirement income: Social Security strategies 🧾, investment planning 📈, and leveraging tax-advantaged accounts 💵 so your savings go further.

Healthcare in Retirement 💊

We’ll walk through Medicare options ⚕️, supplemental insurance, and proactive steps to manage healthcare costs—building confidence for your future.

Building Your Legacy 🏡

Estate planning matters. We’ll help you create wills 📜, name beneficiaries, safeguard your assets, and help you leave a meaningful legacy.

Staying Active and Engaged 🎉

Retirement is the time to flourish! Get tips for staying healthy 🏃♀️, connected with loved ones 🤝, and involved in community or volunteer activities 💃.

-

Yes, You can roll over your 401(k) to a traditional IRA without any taxes or penalties, as long as you follow the IRS rules. The easiest and most common way is a direct rollover, where your retirement funds move straight from your 401(k) to your IRA. This way, you never touch the money yourself, so there aren’t any tax consequences or early withdrawal penalties.

If you decide on an indirect rollover, the check comes to you, but your employer withholds 20% for taxes. You’ll need to deposit the whole amount (not just what you received) into your IRA within 60 days to avoid taxes and the 10% penalty if you’re under 59½. Missing the deadline can trigger taxes and penalties, so direct rollovers are usually safest and simplest.

-

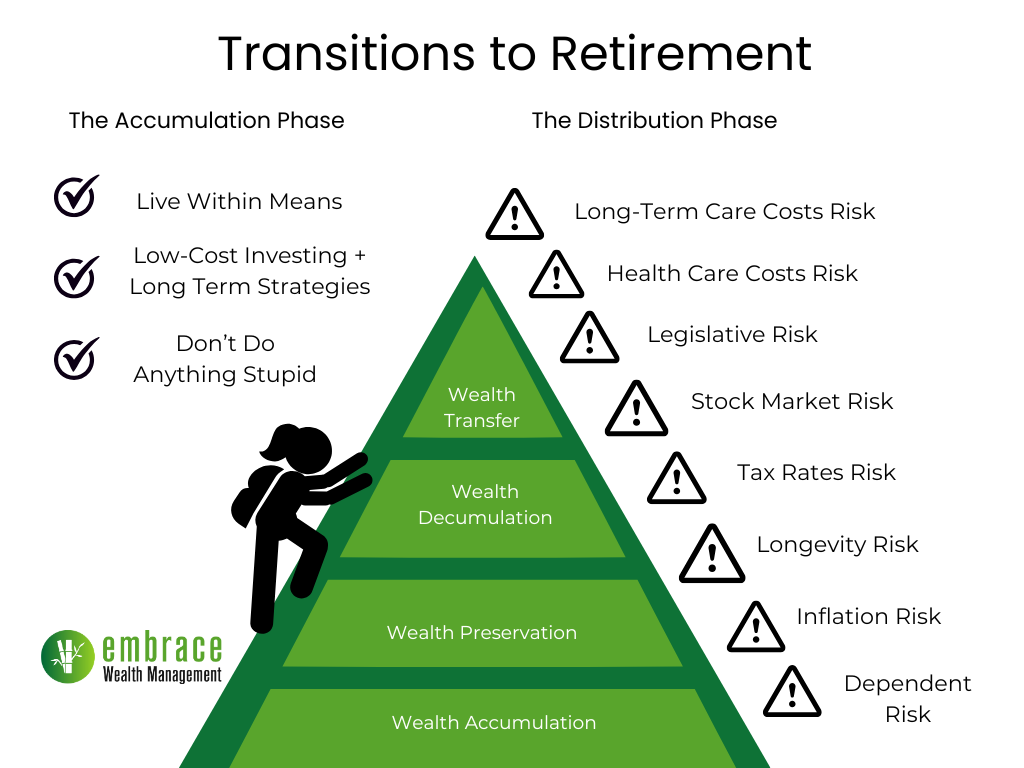

Women tend to live longer than men, which means your retirement savings may need to stretch further. Start by reviewing your spending needs and creating a realistic budget that includes healthcare, housing, and leisure. Consider working with a financial planner to develop a sustainable withdrawal strategy, such as the 4% rule or a dynamic withdrawal method. Factor in inflation, unexpected expenses, and possible long-term care needs. Revisit your plan annually and adjust as your circumstances or market conditions change.

-

Delaying Social Security benefits until age 70 can significantly increase your monthly payments, but the right claiming age depends on your health, income needs, and marital status. Understand how your past earnings, spousal benefits, and survivor benefits impact your payout. If you have a STEM career with higher late-career earnings, this can boost your benefit calculation. Be mindful of how part-time work or other income sources may affect your taxes and Social Security income. Consulting with a retirement specialist can help you optimize your claiming strategy.

-

Healthcare is often one of the largest expenses in retirement, so factor in premiums, out-of-pocket costs, and potential long-term care. Consider supplemental insurance (like Medigap or Medicare Advantage) and review your coverage annually. Health Savings Accounts (HSAs) can be a tax-efficient way to save for medical expenses if you are not yet on Medicare. Explore long-term care insurance options early, as costs rise with age and health changes. Building a dedicated healthcare fund can provide peace of mind.

-

Diversify your income sources—combine Social Security, retirement accounts, pensions, and possibly annuities. Consider part-time work, consulting, or monetizing hobbies for additional income if desired. Review your investment allocation to balance growth and safety, shifting to more conservative investments as needed. Maintain an emergency fund for unexpected expenses. Regular check-ins with a financial planner to help ensure your plan remains on track as you age.

-

Understand how withdrawals from different accounts (401(k), IRA, Roth, brokerage) are taxed, and plan your distributions to minimize your tax burden. Consider strategies like Roth conversions or drawing from taxable accounts first. Be aware that Social Security benefits may be taxable depending on your total income. Take advantage of tax credits and deductions available to retirees. Work with a tax professional to optimize your strategy and avoid surprises.

-

Ensure your will, power of attorney, and healthcare directives are up to date. Consider setting up trusts if you have complex family needs or wish to control how assets are distributed. Review beneficiary designations on retirement accounts and insurance policies regularly. Charitable giving, whether through direct gifts or donor-advised funds, can be part of your legacy plan. Consulting with an estate attorney ensures your wishes are clearly documented and legally sound.

-

Organize all financial accounts, passwords, and important documents in a secure, accessible place. Understand your rights to survivor benefits, pensions, and Social Security. Seek professional advice before making major financial decisions during periods of grief. Build a support network of trusted friends, family, or advisors. Financial empowerment and awareness are key to maintaining independence and security.

-

Stay invested, but adjust your risk tolerance to reflect your age and needs. Focus on income-generating investments such as dividend stocks, bonds, or annuities. Consider real estate or other passive income streams if appropriate. Join investment communities or educational groups tailored for women to keep learning and stay engaged. Periodically rebalance your portfolio to maintain your desired asset mix.

-

Many retired women find fulfillment in giving back, whether through volunteering, charitable donations, or supporting family members. You might consider setting up a donor-advised fund, making regular charitable contributions, or volunteering your time and expertise to local organizations. If helping family is a priority, be clear about your own financial boundaries to avoid jeopardizing your long-term security. Estate planning tools, such as gifting strategies or trusts, can help you manage how and when you provide support. Giving back can offer a sense of purpose and connection, but always ensure your generosity aligns with your financial plan and retirement goals.

-

It is wise to seek guidance from Certified Financial Planners (CFP), retirement specialists, or reputable financial institutions that understand the unique needs of women in retirement. Many banks, investment firms, and nonprofit organizations offer educational workshops, online resources, and one-on-one consultations. Community centers, local senior groups, and online forums can provide both practical advice and social connection. Staying informed through reliable sources and building a network of supportive peers can help you navigate financial decisions and enjoy a more secure, fulfilling retirement.